Blogs

Before delivering on ‘chain of title’, property survey, title insurance and closing, title companies need vendors, Title companies have to complete a series of tasks. Each of the tasks may need a specialized vendor and therefore the key to successful operations for any title company lies in the quality of their vendors.Anyone working in the title industry is familiar with the many moving pieces required to complete a single closing. It can often be overwhelming. Leading title experts say that when work is at its peak, time management is the ultimate skill – even above the intricacies involved in a closing. Yet, surprisingly many title companies are still handling their vendor tasks manually. As a result, companies need to proactively and frequently follow up with vendors to get work done. Unfortunately, the regular manual check-ins can add a considerable amount of time and cause essential tasks to be left behind.Luckily, modern title companies can improve vendor management by embracing new-gen solutions that avoid mistakes and speed up performance.Simplified Vendor ManagementChoosing the right vendors can make the difference between success and failure for a title company. For instance, have you tried to count the number of steps on your to-do list to complete an order with a vendor? Right from placing the order to fulfilment of payment – it goes on! Furthermore, if you end up working with the wrong vendor in this process, it can cause a significant setback in your operation and delay the closing by weeks or months. On the contrary, using an automated workflow for your vendors will make your business more efficient. Also, it will ensure that your team is consistent without having to reinvent the wheel on every closing.AtClose understands the value of vendor management and the responsibility that comes along with it. Every vendor needs to ensure compliance but having a system in place helps both vendors and title companies in the long run. Thus, we created a cloud-based workflow solution that offers a single point of integration for title companies to connect with vendors. With reporting and vendor score-carding, vendor performances can be easily rated on the dashboard, helping companies automate their orders and accelerate closing.Benefits of Auto-Assign and Follow-Up for Title CompaniesSimplified Vendor ChecklistOur dashboard offers clear set guidelines with E/O, background checks, tracking, and more. So, title companies can ensure that all vendors comply with the set terms and orders depending on the company policy. This saves the time and hassles of choosing a vendor and vetting them.Past & Present Vendor PerformanceBusinesses often revolve around relationships. Unfortunately, a good relationship can mask vendor performance that isn’t up to the mark for your business. In a worst-case scenario, it could even be hurting your business. With ratings on vendor performance based on their past performance, you know how your vendors are doing. Reporting benchmarks and ratings help improve performances and set a quantifiable measurement scale.Smart Vendor Rating SystemWhen there’s a transparent rating system for every vendor, title companies can easily auto-assign orders based on the vendors’ past performance. Our dashboard also considers the availability and skill levels of the vendors to ensure they complete the tasks on time. As a result, it reduces the hassles of manual follow-ups and avoids delay.Efficient Vendor ProcessingThe automated platform minimizes human errors, and title companies enjoy smooth, efficient and error-free processing. Title companies can also build, configure and automate workflows and thus, streamline their tasks to improve efficiency and save time and costs.Real-time Communication with VendorsOur portals ensure real-time communication with vendors to submit orders and upload the completed task reports. The orders are sent in a consistent format, eliminating the requirement to change formats or redo them with new vendors constantly. In addition, the order management dashboard offers easy global access, enabling title companies to work with top vendors with simplified communication.Scalability for Business GrowthAtClose believes that an intelligent vendor management portal should be a highly scalable platform that can easily enhance vendor-related functions. Therefore, our vendor portal supports integration into existing business systems, vendor due diligence, scalability for new vendors, and more.Think of all the reduced steps on your to-do list when orders can be auto-assigned to the right vendors and completed without having to check on them constantly! Apart from offering benefits to your company, automated operations and an innovative dashboard are also highly effective for vendors. Vendors prefer solutions that are easy to use and friendly. We built the dashboard on the principle of delivering best-in-class functionality with top benefits for all parties involved. The intuitive technology makes it an asset for vendors as well.AtClose delivers an order management dashboard that helps title companies like yours empower your business partners. You can connect, collaborate and automate operations and processes for smooth order completions. Consult our industry experts to see how our new-gen solutions simplify your vendor management.

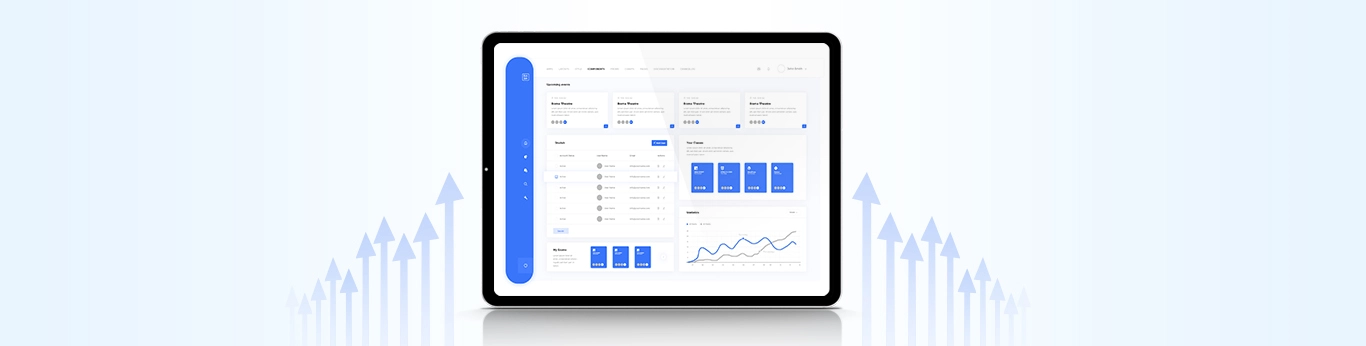

Business leaders know that innovative technology is the key to keeping a competitive edge in their respective industries. When analyzing if any new tool is right for their operation, these leaders consistently rank user-friendly interfaces as a key factor in their considerations. And rightfully so! A workforce’s collective and individual user experience is the make-or-break factor for an organization’s total adoption of new tech. Simple yet comprehensive interfaces create positive experiences with confidence and satisfaction. But how does an organization deliver on that? “Simple yet comprehensive” is a lot more complicated than most imagine.The Power of Feedback Most ideas are born out of necessity. An individual or a team gathers, locks the door, and focuses inward. They whiteboard, brainstorm, and go to market. What they lack however is feedback, experience, and user input. The Power of Feedback is invaluable, and AtClose knows it. That’s why over the past several years we’ve been interacting closely with our customers, intently listening, and embracing the feedback that has come from them. We’ve sought to understand what customers need, how they think and why they act the way they do. These insights have enabled us to stay at the forefront of technology when it comes to next-generation digital mortgage, title and escrow solutions. With our customers as the focus, we’ve upgraded our UI/UX designs and are delivering far superior experiences.A New Color Palette Keeping user-health and productivity in mind, AtClose exhibits a new palette of colors and contrasts. Backed by optic science, a more visually appealing experience for all users aims to lower stress and eye strain when spending long hours within the AtClose system.A Simplified NavigationWith a total system as comprehensive as AtClose, quite often a user’s journey can become inconvenient and disruptive. The sheer number of features available can complicate the situation beyond ideal. Studies showed that AtClose users were on average clicking 5 times to get to a feature and complete a task. While some of this complexity is unavoidable, AtClose engineers were able to create a Simplified Navigation that can get most tasks completed in as little as 2 to 3 clicks. This increased ease of access should result in faster task completion and a more satisfied user experience.An Upgraded Typography Continuing to refine the ease of use of the platform, we have modernized the fonts as well. Typography in UI/UX design is more than choosing a font. It can enhance the usability, readability, accessibility, and hierarchy within the interface. Our new typographic designs allow users to complete tasks faster with minimal errors in reading or processing.Benefits of the New UI/UX to Title CompaniesIt is no secret that AtClose is on a mission to dominate the nationwide market. And to do so we know we must win the hearts and minds of our end users. Our progressive efforts to modernize our UI/UX is something our new users have reported to us that they just cannot get anywhere else. Other systems remain outdated, stuffy, and boring, while we wholeheartedly believe our upgrades serve the best interests of our users, their businesses, and their customers. If you’re a business leader looking for the next-generation digital mortgage, title, and escrow solutions that only AtClose can offer, sign up for a demo, and we will be happy to showcase AtClose and its latest UI/UX advancements.

Everyone in the mortgage industry knows the evils of friction in the mortgage lending process. What has remained a pressing problem for the industry for decades now is isolating the causes of the friction and smoothing out our processes so that the best possible outcome can be achieved.Making the problem more complex is the fact that originating a mortgage loan involves multiple external partners. Every new product or service required by the lender to originate has the potential to add more friction to the process. The same can be said for mortgage servicers who are navigating the default servicing process. As a full-service IT consulting and services company serving global brands for over 25 years, we wanted to take a closer look in the hope that we could find the source of the problem. We found it. The friction is in the order management process. APIs allow lenders to connect to anyone they want, but once that connection has been established, they must start sending data to each other, tracking what has been ordered and what has been received and when and by whom. Easier integrations between parties have not made our business simpler but rather more complex. In our new paper, we offer a candid exploration of the market’s current challenges and explain why friction in the order management process is still costing lenders too much time, money, and business. We’ll also give you the key to higher levels of customer satisfaction. It’s all about planning ahead and making sure that your organization is able to offer digitized experience to its customers.EIN Presswire also featured the release of our whitepaper.The new White Paper is available to be downloaded.

The mortgage market experienced an all-time high in 2021 thanks to a mix of low interest rates and limited availability in desired areas leading to an overall increase of 16.9%, according to data from Freddie Mac. The Mortgage Bankers Association forecast says that 2022 could be a transition year, moving from a refinance market to a purchase market.The work volumes for a title agent are directly dependent on the fortunes of the mortgage industry. The cyclicality of orders leads to work volume flux making it important for title agents to plan their workflows in a way that can let them meet scaled up volumes comfortably.According to data from Freddie Mac, 2021’s mixture of low interest rates and high demand elevated the mortgage industry to record levels across the board. Optimistically, the Mortgage Banker’s Association has forecasted 2022 to continue these with trends. For a title agent, this is great news, as it offers a great deal of promise, opportunity, and security for the foreseeable future. Which is why the best title agents and organizations are focused now more than ever on working smarter, not harder.Multiple vendor partnershipsIt is also a given that title agents have to work with multiple vendors and partners as they try to meet the influx in refinances and home sales. There are several moving pieces and partnerships need to be in place in order to scale. Each vendor partner comes with certain specialized service expertise and greater proficiency in a particular field. It’s often overwhelming which means there’s a high need for a vendor ecosystem for increasing operational efficiency.However, managing multiple vendors can be complex and expensive. There are a number of factors that can leave title agents perplexed while managing multi-vendor relationships like costs, time and resources. There is also a risk of incompatibility between the technology that different vendors use. Most title production systems will also have their existing integrations with multiple systems that may or may not allow to add new vendors as required.Smart Title Agents already have networks of service providers. Whether they are part of a large company or small shop, agents rely on this network to handle complicated and specialized services and provide the expertise needed to get the job done. There are a lot of moving pieces, and it can easily become overwhelming to operations of any size. Also, the costs of time and resources spent on incompatible technology can be a hard lesson to learn, and oftentimes threaten the livelihood of the entire company.Single dashboard for vendor relationshipsHowever, the need is for a single dashboard that integrates all information related to different vendors as an integrated ecosystem to achieve high vendor management effectiveness. A single dashboard provides the required capabilities to manage complex ecosystems, monitor vendor performance and leverage vendor capabilities in order to drive innovation, cost savings, and efficiency gains. The necessity for integration is inevitable to for all vendors to ensure convergence and end-to-end service integration.Surprisingly, many title agents are still struggling with having a single dashboard. They often spend time in frequently checking work by different vendors to ensure that the completion of tasks is happening, as per plan. These check-ins add up to an exhaustive amount of time and can easily lead to important tasks slipping through the cracks.Most Title Agents agree that a single platform for vendor management would drastically decrease their stress levels by streamlining their efforts in to one system. A single dashboard provides the required capabilities to manage complex ecosystems, monitor vendor performance and leverage vendor capabilities to drive innovation, cost savings, and efficiency gains. Title Agents that have used a single, robust vendor management system often refuse to use anything else thereafter. The benefits to each individual worker are overwhelmingly obvious.Robust cloud-based system for vendor dataAs a title agent, what you need is a robust system where your vendors can upload data related to their orders on one central system on the cloud, so that the dashboard always stays updated. This system becomes your single, cohesive point of data exchange with your vendors, and one that saves time and reduces error rates for you. It helps improve the ability to work with key vendors seamlessly and deliver superior integrations to provide efficiency and reduce manual effort.Considering our new workplace dynamics, the benefits of a cloud-based system are also proving their worth. Centralized systems in the cloud offer flexibility to workers who may work from offices or home, or even their local coffee shop. Being that the cloud-based systems are technology agnostic, companies can maintain important levels of platform uniformity across various workspaces and hardware.Importance of open integrations networksWhile using a cloud-based system, it helps to have an open integrations framework where all vendors can be directly integrated with ease in the ecosystem. Such a system has strong vendor management capabilities and acts as one centralized hub for all things related to vendor management. The open integration provides seamless access to vendor data and offers immersive information for informed decision making. It is developed on open standards which makes the entire process of adding and replacing components easier.SummaryAtClose offers open integration framework that can be directly integrated with all major vendor systems. By implementing AtClose, many businesses in the Title & Settlement industry have significantly improved their bottom line. AtClose users experience several benefits like improving accuracy, reducing repetition, enhancing vendor relations, and saving time with the powerful Title & Settlement features of AtClose.With a high level of customizability, AtClose’s suite of solutions adapts to the specific operational processes of your business, significantly reducing closing time. This combination of value, ease of use, adaptability, and performance makes AtClose an ideal choice for Title & Settlement businesses of any size.Get in Touch to know more.

The mortgage rates have been low, around 3% in 2021 and are forecasted to remain low at 3.5% in 2022. This has led to increased purchase volumes in mortgage origination by 11%, amounting to $1.8 trillion. To meet these increasing demands, Title companies have been striving to streamline their production.Ensuring faster turnaround times and complete accountability for every order are items on their priority list.To be able to meet these demands, title companies need to transition from their traditional methods to technology based and mostly cloud-based solutions.Title companies and agents have to be nimble, fast, and responsive in this age to remain relevant in the industry. Therefore, title agents must adopt a fully functional cloud-based title production platform to meet these demands.A Quick Insight on Cloud-based Title SolutionsOn a broad scale, a cloud-based solution is a system where services or resources are provided to users on-demand on the cloud.A cloud-based title solution is a model where end-to-end title services are rendered to customers on-demand from a fully functional cloud-based title production platform.As a result, it improves workflow efficiency and, on the other hand, creates a better experience for customers.How Cloud-based Title Solution Beats The Traditional Operational ModelAccording to a resource on Forbes, 61% of borrowers submitted applications online in 2020 compared to 58% that submitted applications online in 2019. From the statistics, it is clear that the technology-based processes are growing compared to the traditional model. Cloud-based solutions continue to gain relevance and are clearly the future of title production. According to ABA Banking Journal, many financial service providers now use cloud technology. They are estimated at 83%, with the United States leading with 54%, Canada with 52%.The reason is straightforward; cloud-based title solutions make things faster and better for title companies.The points below show how a cloud-based title solution shakes off the old ways of title production.Faster Turnaround TimeImagine having all players involved in the title production in one system. That’s what a cloud-based solution offers.Title agents and other 3rd party companies can kick start the process immediately and connect faster with the parties involved through the cloud-based server. As a result, each process stage is completed faster, resulting in a faster title closing.Better Data ManagementGone are the days of dealing with chunks of papers as documents. The cloud-based solution provides a better way to store, manage, track and retrieve large volumes of data in a digital form.Flexibility and ScalabilityThe cloud-based solution provides a flexible structure to title companies because they can easily integrate new systems and changes.The ability to easily integrate trending quality models improves the scalability for the title company.Improved Customer ServiceSuper-fast and easy communication between title agents and customers is a tremendous positive from a cloud-based solution perspective.The provision of real-time communication helps retain customers and even attract newer ones.Cost-efficiencyThe cloud-based solution proves cost-effective because title companies and agents don’t need to spend on hardware and other installations.On the other hand, since it makes processes faster and effective, there is no situation of extra cost due to duplication of processes.Better Customer ExperienceMillennials prefer digital means of title production. A survey shows that 63% of consumers, of which millennials constitute a large percentage prefer the digital mortgage process to make things easier than in-person transactions.When things go fast and smooth, customers love it, and cloud-based solutions guarantee that. In no time, title companies begin to enjoy an inflow of new customers.AtClose Makes You Future-Ready With Cloud-Based Title SolutionAs a title agent or company, you need to improve workflow efficiency, scale, and be future-ready. Your best option is to have a fully functional title production platform like AtClose.AtClose is a cloud-based title solution that offers the best functionalities and features. It is a workflow solution that handles end-to-end title production and streamlines the entire title production process.AtClose FeaturesThe AtClose cloud-based platform has the best features for optimal title production. Let’s see these unique features.Advanced Vendor Management ModuleAtClose provides everything about vendor management in one hub. Imagine an interactive platform with easy navigation providing the following;A secure vendor portalAuto assigns and follow upVendor rankingVendor complianceVendor reportingVendor integration frameworkNotification and alertsThe experience is all encompassing and top-notchEnd-to-end Title ProductionAtClose gives the provision to place and tracks orders. It also provides the functionality of uploading the completed title product automatically.Other features include:Open integration frameworkFast track closingPrice quote setup and calculatorReporting frameworke-signing module etc.Key Benefits of A Future-Ready Cloud-based Solution From AtCloseThe AtClose cloud-based solution brings so many benefits to the entire mortgage industry. So without much ado, let’s see what these benefits are.AutomationWith AtClose, all processes are automated, hence eliminating common manual errors. From automated vendor ranking to automated assignment and many other processes.Simplify and OrganizeThe whole title production becomes simple and easy to organize. AtClose organizes the process into a simple workflow for a better client and vendor experience.Easy to integrateAtClose enables easy integration of systems. It can directly integrate with all major lenders and vendors in the pre and post-closing ecosystem.Can you imagine the smooth end-to-end title services you can render to your increasing stream of customers with an optimized cloud-based solution like AtClose? It’s a win-win situation as you give your customers the best experience and improve your closing ratio.

Lenders can now close more loans faster due to rapid technological innovations and digital advancements. However, every lender interacts with many different vendors to complete the process and vendor management is often the biggest challenge and an unknown cost escalator in scaling businesses for real estate and mortgage companies.Lenders manage various providers for their loan fulfilment services. This can result in high fees, frequent order fulfillment delays, lack of uniform vendor compliance and lack of standard reporting or consolidated visibility. Also, many lenders aren’t able to track the performance of vendors, making it difficult to choose the right ones that will help them meet their long-term business goals.In such instances, an order management dashboard offers a viable alternative to focus on critical tasks based on their priority. It can help efficiently organize business processes, including high-volume tasks and repetitive undertakings, without requiring human intervention at every stage. As a result, it reduces workforce cost, time and boosts operation speed. In an omnichannel world, leveraging order management dashboards helps overcome the countless logistics and practical challenges lenders face.Here are the Top 5 Benefits of having a High-Performance Order Management Dashboard:1. Improving Adherence to ComplianceLenders can set the compliances for vendors on the dashboard and even customize it as per different vendors. This can include E/O, background checks, tracking, etc. On the dashboard, it becomes easier to ensure that all vendors comply with the set terms and orders as per your company policy.2. Reducing Errors in Data EntryWith highly automated platform, the chances of human error are minimized. As a result, lenders can place and track orders without errors, and vendors enjoy smooth, efficient and error-free processing. It also saves a lot of time for all the parties involved.3. Streamlining Repetitive Tasks via WorkflowsLenders can build, configure and automate workflows on the order management dashboard to streamline tasks, improve efficiency and save time and cost. They can manage workflows for title/closing, appraisals, verification, credit, BPO, AVM, flood, and more. Workflows are powered by AI and built using a combination of human-powered and automated tasks. They can flawlessly execute repetitive tasks and need minimal human intervention.4. Reducing Production Costs and Increasing ProfitsWith order management dashboard, you empower your business partners to connect, collaborate and automate operations. As a result, it eliminates manual processing, high costs, paper documentation and more. The dashboard significantly increases operational efficiency, boosts customer service and generates new sources of revenue. In addition, the quick access to vendors, faster orders and timely deliveries with monitoring gives operations many more opportunities to succeed and enhances profitability.3 Ways in which AtClose is leveraging Order Management Dashboard:1. Workflow Event TrackingThe order platform for title and settlement, appraisal, and other ancillary products ensure defined events and workflows that support efficient operations for your business. You can track all delivered services under one platform and expedite pending requirements accordingly.2. Dynamic Integration Framework for the Lender PortalThe lender’s portal provides the best value, adaptability, performance and ease of use for all your business transactions. You can place orders, view status, download or upload documents for the project and configure it in a way that ensures all your processes are completed smoothly.3. Responsive Vendor PortalThe portals ensure real-time communication with lenders wherein vendors can submit orders and upload completed task reports. The orders are sent securely in a consistent format, eliminating the need to constantly change formats or redo them whenever working with a new lender. It’s a web-based and cloud-based order management dashboard with easy global access. The portal is easily scalable as and when orders grow.With an order management dashboard, you can strengthen your competitive edge in a highly competitive marketplace and constantly monitor order progress, fulfilment, tracking, and more. If you are struggling to manage vendors and need a streamlined and systematic solution, AtClose Exchange has the perfect high-performance dashboard for you.

Pagination

Demo

Request a Demo