A Step Ahead

New generation of title solutions

Enterprise title and escrow production software.

21,000+

Users

50,000

Monthly Closing

35+

Enterprise Customers

50

States Coverage

60+

Integrations Partners

AtClose – Next

Level Solutions

Cloud based, secured title production system with configurable workflows, multiple integrations and the latest UI to help you close faster.

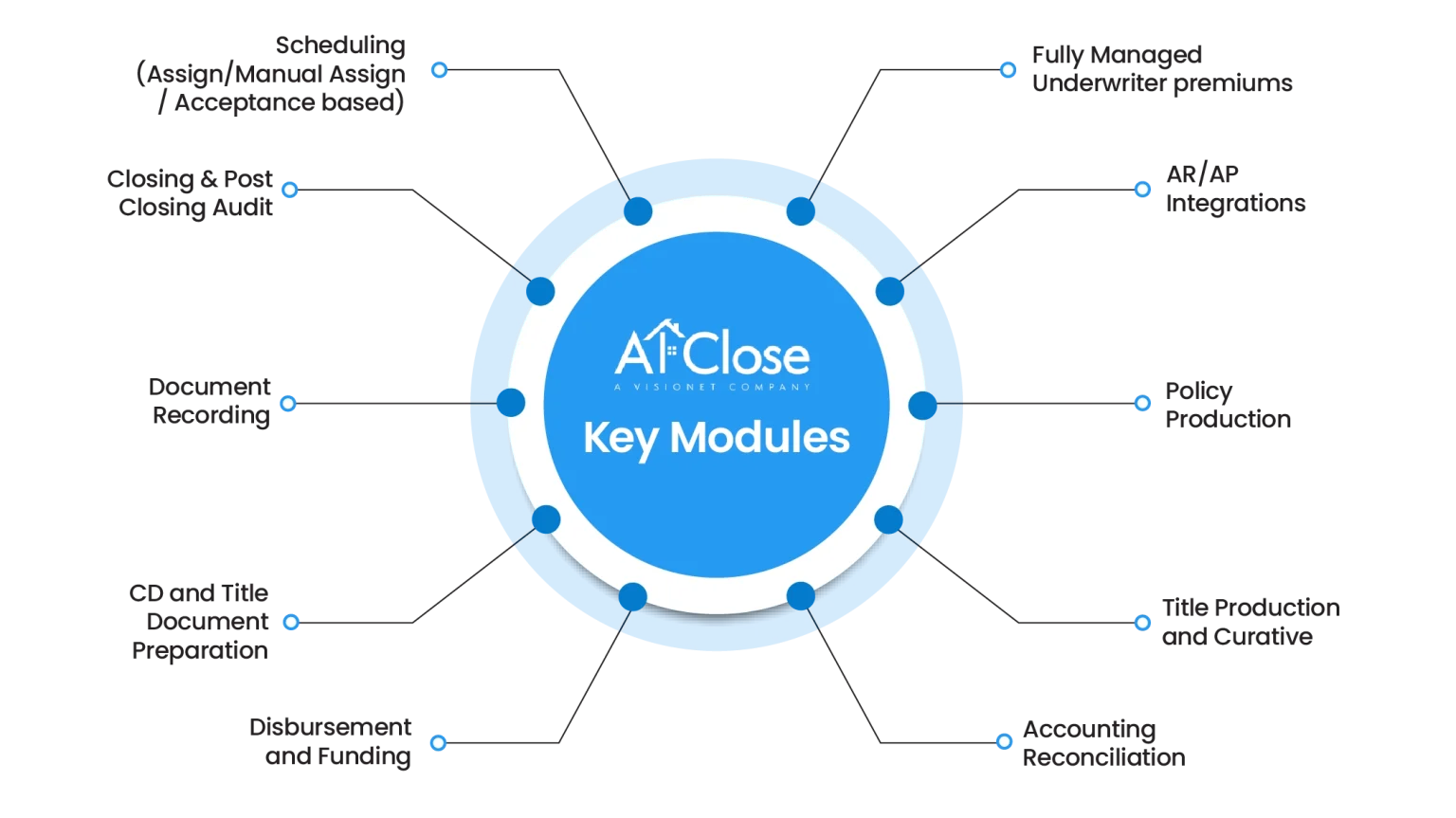

Streamlining title & settlement

process with AtClose

AtClose empowers title and settlement professionals with a comprehensive suite of modules designed to enhance efficiency and

accuracy. From seamless scheduling and closing management to post-closing audits, AtClose ensures a streamlined and fully digital workflow.

Key Benefits

Improve accuracy, reduce repetition, improve vendor relations, and save time with the powerful and comprehensive software platform for the Real Estate Industry.

Internet and browser required

Fully secured with security controls

Scale from 20 to 20,000 users

Fully configurable workflows

Multiple title company management with centralized database

Role and rule based security

Manage your national vendors with order assignment

Vendor ranking and performance management

Vendor compliance management

60+ integrations

Scalable Open API framework

Case Studies

Real-world examples of how implementing AtClose can help you overcome

the challenges of title document preparation, vendor relationship management, and more.

Trusted Market Leaders

Shanon M. Lake-Catello

SVP Technology & Vendor Management, America’s Settlement Company :

Deciding on a technology provider for your business is a tough decision, AtClose made it a simple

one over 10 years ago. Knowledgeable staff providing reliable innovative solutions for our business

and our customers’.

AtClose | Blogs

AtClose | Latest News

Brochure & E-Book

Request a Demo