Are you wondering where the future of mortgages is heading? We know the situation might be a little complicated as of now, however, one must be prepared.

Here’s a bit of context. The mortgage industry has undergone significant changes in recent years, with technological advancements driving a shift towards digital mortgage solutions. The benefits of digitization in streamlining the mortgage order processing have been widely recognized, leading to faster turn-around times and improved accuracy. However, the reliance on third-party vendors for critical services continues to pose a challenge, introducing friction and uncertainty into the process. In this article, we explore the impact of digital mortgage solutions on the industry and the challenges that mortgage originators and servicers face in managing a large cohort of vendor partners.

The mortgage order processing typically involves multiple parties, including the borrower, the lender, the mortgage broker (if applicable), the title company, and the appraiser. Each party plays a crucial role in mortgage processing and must communicate and coordinate effectively to ensure a smooth and timely process.

The Impact of Technology

In recent years, advances in technology have helped to streamline mortgage order processing by automating many of the manual tasks involved in the process, such as document processing and verification. This has led to a more efficient and streamlined process, with faster turn-around times and improved accuracy.

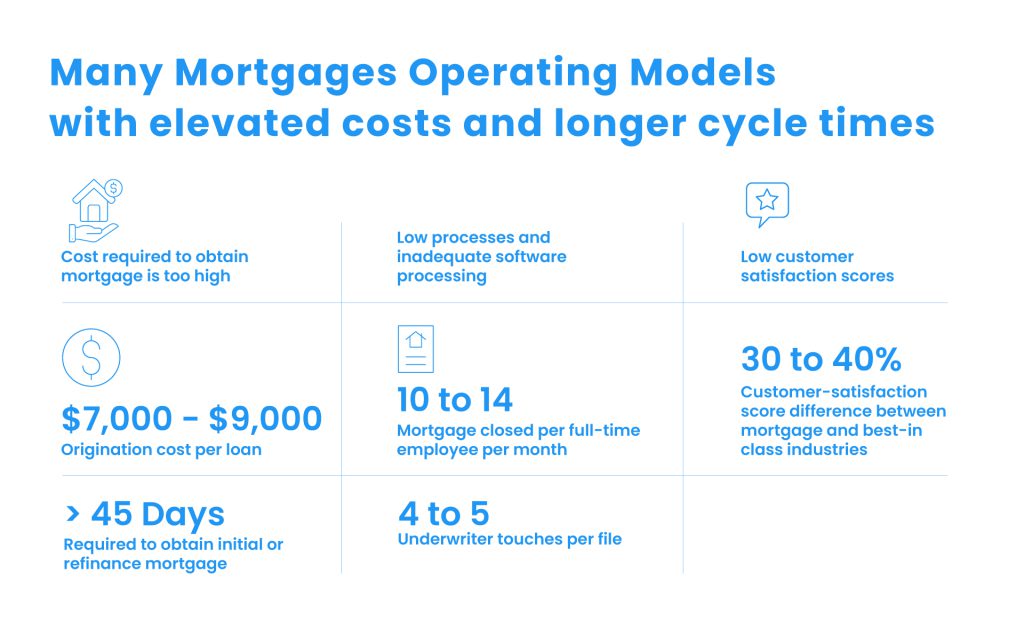

Mortgage originators and servicers continue to face complex challenges, including high volumes and stringent regulatory oversight, all while managing a large cohort of vendor partners. And the rising interest rate environment is forcing more burdensome changes, including increased competition from the reduced refinance business.

Reference: www.mckinsey.com

Reaping the Countless Benefits of Digitization

Digital mortgage solutions optimize the process of closing by streamlining and automating many of the steps involved. Borrowers can apply for a mortgage online, saving time and eliminating the need for in-person visits. Lenders can collect and process information more efficiently, reducing the chance of errors and delays. Digital mortgage solutions can also automate tasks such as document verification, underwriting, and title searches, further speeding up the process. This can result in a faster closing process, with less paperwork and a smoother experience for all parties involved.

Influence of Digital Mortgage Solution Across Industries

However, it’s quite often not the lender’s operation that is the problem. For both mortgage originators and servicers, that large cohort of vendors must rely on third-party partners that introduce friction and uncertainty into the process. And automation is only as good as the information flowing through, which comes from a gray area of no control nor visibility.

For example, what if a loan processor using a modern LOS to order a flood certification, title report, AUS decision or data verifications does not receive the data after order placement? A default servicer will work with a number of third-party vendors to gather collateral valuation, title information, property inspections, and field services reports. The servicing platform can place the orders easily enough, but then what?

While lenders and servicers have focused a lot of attention on making their internal processes as efficient as possible, they can’t keep tabs on third-party partners and their processes. The lack of visibility there means that they often encounter failure points that waste time, increase costs and destroy borrower satisfaction.

The result is that they will be less competitive than their peers and run higher non-compliance risk in the current regulatory environment.

For more information, please download a copy of the new White Paper on our website or see the feature article in Housingwire.